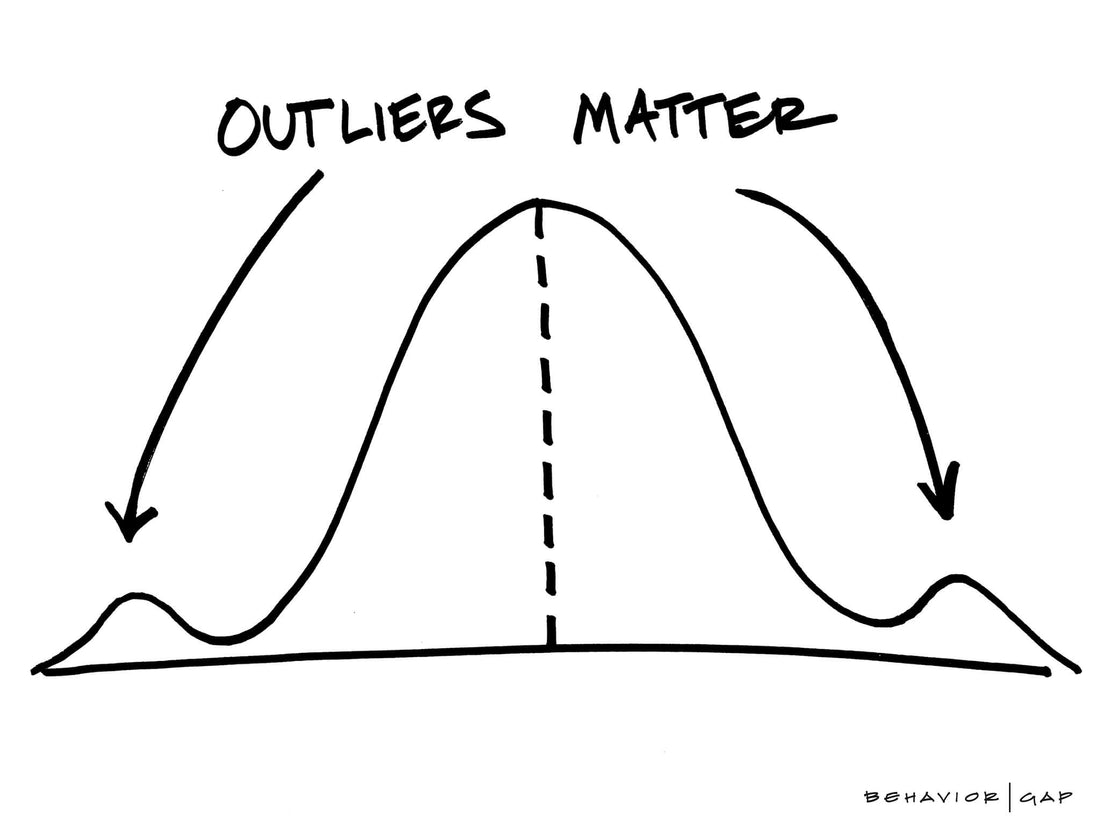

There is a long-standing debate over the difference between the social sciences and the physical sciences. It’s clear that economics is a social science. As such, many of the tools we use in the physical sciences will simply not work. One of the tools is the bell-shaped curve or normal distribution.

Normal distribution is an appropriate way to measure a natural phenomenon. For instance, let’s say we put 50,000 adult, American males in a football stadium. Using normal distribution, it would be appropriate to say that the height of those adult males would be distributed around 70 inches with a standard deviation of plus or minus two. Weight and height would be normally distributed, too, among the males in the stadium.

However, if we decided to measure wealth, and Bill Gates was in the stadium, it simply would not work to apply a normal distribution. It wouldn’t work to say he is an outlier. He would completely blow the distribution because he’s likely to have more wealth than everybody else in the stadium put together. So, normal distribution modeling or bell-shaped curves work for natural phenomenon. They do not work for economics, a man-made phenomenon and social science. It’s important to understand the distinction.