I had the pleasure of chatting with the folks at The Motley Fool as part of the series they did on financial advice. While the title of the first story alone makes it worth reading (“How to Thwart the Opaque, High-Fee, Underperforming Financial Advisors Who May Be Mismanaging Your Money”—I love it!), they do a great job, over seven articles, of outlining what to look for in an advisor and some of the other issues around financial advice.

The truth is most individuals would probably benefit from financial advice. Saving and investing is complicated, and most of us need help making decisions on asset allocation, diversification, and retirement vehicles, to name just a few challenges. The experts cited in this series agreed that financial advice can be invaluable for many investors.

The work real financial advisors do changes people's lives. This is true!

Fake financial advisors can destroy people's lives. Sadly, this is also true.

Because the media stories are almost always about the fake advisors, sometimes even the real ones doubt their value. It's easy to do. After hearing the 97th story about how easy it is to do everything a (fake) advisor does, you start to wonder about the value of your work.

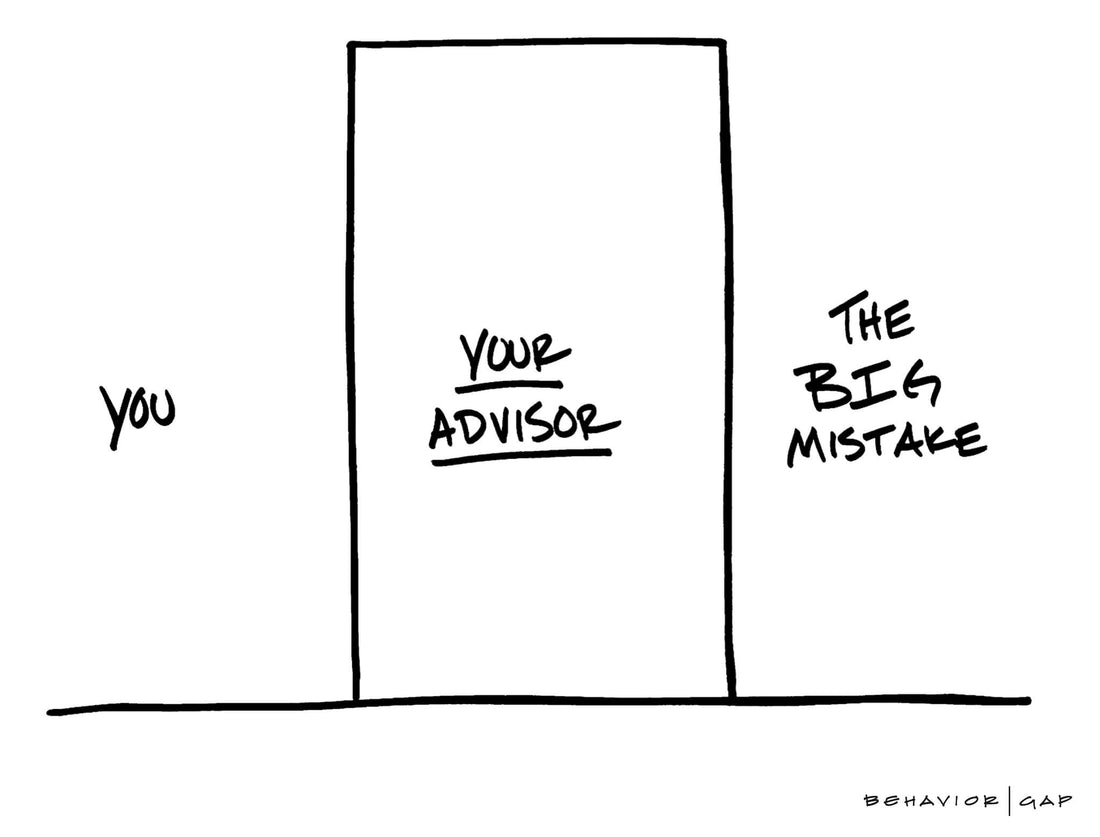

But let me be clear:Because behavior plays such a huge role in a client's lifetime success, helping clients behave well in scary markets is massively valuable. It is critical that real advisors understand and believe that. Instead of learning how to justify the fee you charge a client, get so good at your craft that your value isn’t a question.

The work that real financial advisors do is different than the work the traditional financial services industry has done. Real financial advisors all over the world take heart: We’re all working through a massive opportunity together to make a difference in people’s lives.

As investors, we can’t put our heads in the sand when it comes to personal finance. If you haven’t had a chance to do so, I encourage you to read through The Motley Fool’s entire series.

If you are a financial advisor who wants to get clear about your value and how you provide it during scary markets, might I humbly suggest heading over to The Society of Advice. The Society represents some of my most valuable work, and I want as many advisors as possible to have access to it.